On January 11, Federal Reserve Chairman Jerome Powell issued a rare video statement, publicly accusing the U.S. Department of Justice (DOJ) of threatening criminal charges in an attempt to force the Fed to comply with Trump's interest rate policy demands. This incident quickly became a focal point in global financial markets, sparking widespread concerns about the Fed's independence.

In his statement, Powell emphasized that such threats are a "consequence" of the Fed setting interest rates based on public interest rather than presidential preferences, calling it a blatant attack on central bank autonomy. This event is not isolated but the latest manifestation of the intertwining of politics and economics during Trump's second term.

Following the incident, U.S. stock index futures fell rapidly, with S&P 500 futures dropping over 0.5% and Dow futures declining by 150 points during Asian trading hours. Spot gold rose by 1.88%, spot silver surged by about 4%, and the cryptocurrency market saw BTC hovering around $91,000.

Trump Repeatedly Dissatisfied with Powell's "Slow Rate Cuts"

Powell was appointed as Fed Chair by then-President Trump in 2018 and was reappointed in 2022, with his term originally set to end in May 2026. As the head of the Fed, Powell has led the central bank through the challenges of the COVID-19 pandemic, economic recovery, and high inflation, with policies characterized by data-driven and gradual adjustments.

However, after Trump won the 2024 presidential election and returned to the White House, he quickly turned his focus to the Fed. Trump has long criticized Powell for being "slow to act," particularly on interest rate policy. He has repeatedly publicly demanded that the Fed cut rates significantly to stimulate economic growth and stock market performance, even promising during his campaign to "take control" of the Fed to advance his "America First" economic agenda.

The incident was sparked by a $250 million renovation project at the Fed's Washington headquarters. The project, launched several years ago to update aging facilities, has faced controversy due to cost overruns and transparency issues.

In July 2025, Republican Representative Anna Paulina Luna accused Powell of providing false testimony about the project during a congressional hearing and called for a criminal investigation. This accusation did not immediately escalate at the time, but after Trump took office, the DOJ quickly intervened. On January 11, 2026, multiple media outlets reported that the U.S. Attorney's Office for the District of Columbia had formally opened a criminal investigation into Powell, focusing on whether he misled Congress and whether the project's funds were used improperly. A grand jury has issued subpoenas demanding relevant records from the Fed.

On January 12, NBC reported that Trump, in a phone interview, claimed to know nothing about the investigation and again criticized Powell. "I know nothing about it, but he's obviously not doing a good job at the Fed, and he's not doing a good job with the building either." When asked to respond to Powell's claim that the subpoena was a government attempt to pressure the Fed into cutting rates, Trump said, "No, I wouldn't even consider doing it that way. The real pressure on him should be the reality of interest rates being too high. That's the only pressure he's facing."

In his video statement, Powell directly linked the investigation to interest rate policy. He noted that the DOJ's actions were "unprecedented" and aimed at forcing the Fed to lower interest rates through criminal threats to cater to Trump's demands. In the statement, Powell reiterated the Fed's statutory mission to maintain price stability and maximize employment, not to bow to political pressure. He described the incident as a "blatant violation of the Fed's independence" and suggested it was a continuation of the Trump administration's pressure on the central bank.

During Trump's first term, Powell had already clashed with the White House over his refusal to cut rates sharply, leading Trump to publicly call him an "enemy." The timing of this investigation is particularly sensitive: the Fed's most recent meeting kept the benchmark interest rate in the 4.25%-4.5% range, far higher than Trump's desired level.

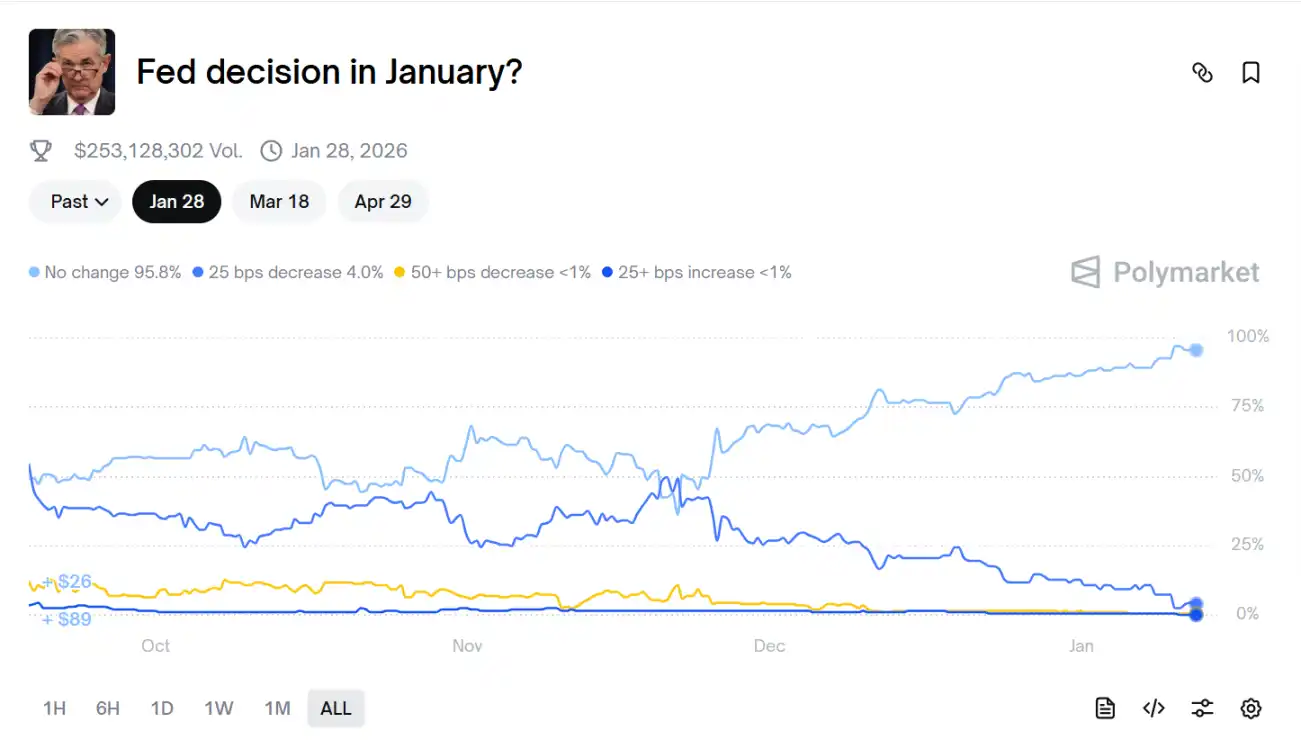

Latest data from Polymarket shows that market bets on the Fed holding rates steady in January have risen to 96%.

On X, supporters see Powell as a hero defending independence, while opponents accuse the Fed of "sabotaging the economy." Some users called for "abolishing the Fed," while others warned that this could trigger a constitutional crisis.

The investigation was authorized by newly appointed U.S. Attorney Jeanine Pirro, a staunch Trump ally, further deepening suspicions of political interference.

Powell responded that he would fully cooperate with the investigation but would not let it influence monetary policy decisions. The roots of this incident trace back to the Fed's institutional design. Established in 1913, the Fed was intended to be independent of politics, but there have been numerous precedents of presidential interference, such as during the Nixon era's Watergate scandal. This event marks an extension of Trump's "deregulation" agenda, as he has already promised to restructure federal agencies, including weakening the Fed's power, since taking office.

As of January 12, the investigation is still in its preliminary stages, with prosecutors repeatedly requesting documents. The White House has not commented. Analysts predict that if the investigation escalates, the Fed may be forced to accelerate rate cuts to alleviate pressure, but this could trigger a rebound in inflation, affecting U.S. economic growth.

Powell himself may face personal risks: if the allegations are substantiated, he could be forced to resign or even face imprisonment, although legal experts consider the evidence weak.

Powell has already responded proactively through his public statement. Moving forward, aside from hiring lawyers to challenge the subpoena's legality, he could also appeal to the courts or seek assistance from bipartisan lawmakers, particularly those concerned about the Fed's independence.

Hassett and Warsh Emerge as Top Contenders for Fed Successor

The criminal investigation into Powell has increased market uncertainty. After the news broke, investors worried that damage to the Fed's independence could lead to policy disorder. Powell's statement emphasized that threatening criminal charges would "undermine" the central bank's credibility, potentially raising risk premiums.

Secondly, this event is seen as a signal of Trump consolidating power, triggering strong backlash from Democrats and social groups. Democratic lawmakers called it a "constitutional crisis," expressing concerns that the DOJ is being weaponized for political retaliation.

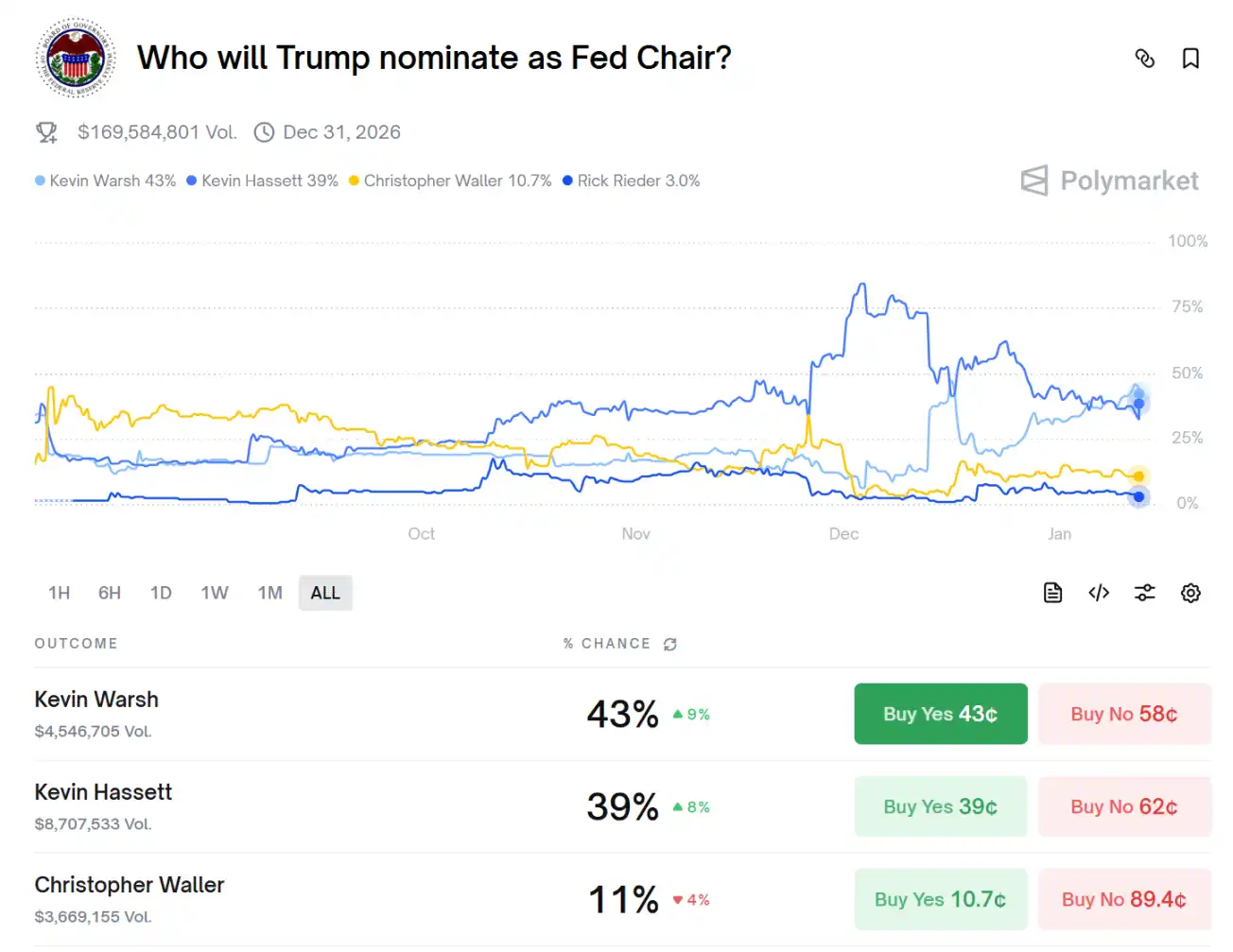

Latest speculation about Fed leadership suggests that while Powell's term lasts until May 2026, the criminal investigation has accelerated discussions about his successor. Trump has stated he will announce his nominee by the end of the month.

Latest data from Polymarket shows that market bets are highest on Kevin Warsh and Kevin Hassett, at 43% and 39%, respectively. Warsh was nominated as a Fed governor by President Bush in 2006, becoming the youngest Fed governor at the time. He is known for his hawkish stance but is market-friendly. In 2017, Trump considered Warsh for Fed Chair but ultimately chose Powell.

Hassett is a well-known conservative economist in the U.S., currently serving as Director of the White House National Economic Council and previously as Chair of the White House Council of Economic Advisers. He supports low interest rates and Trump's economic agenda. In November 2025, he was seen by Trump and his advisory allies as the top candidate for the next Fed Chair.